Wyoming Credit Union: Trusted Financial Solutions for every single Need

Wyoming Credit Union: Trusted Financial Solutions for every single Need

Blog Article

Elevate Your Banking Experience With Lending Institution

Credit scores unions, with their focus on member-centric services and area involvement, provide an engaging option to standard financial. By prioritizing individual demands and fostering a sense of belonging within their membership base, credit history unions have sculpted out a particular niche that resonates with those seeking an extra tailored strategy to managing their funds.

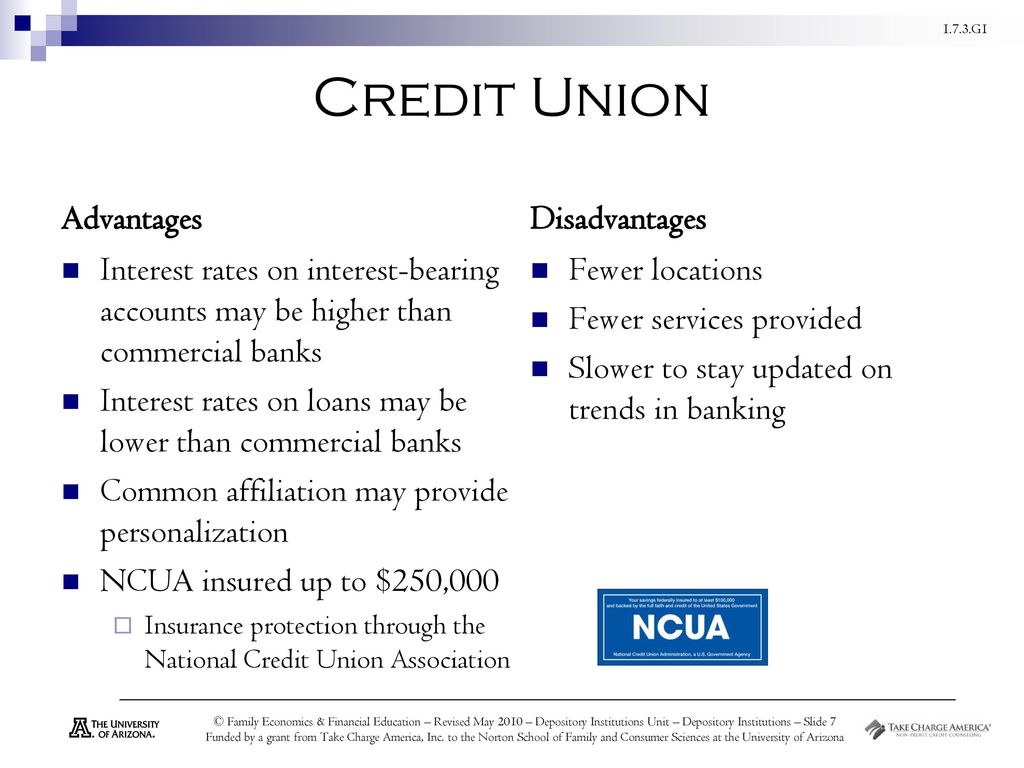

Advantages of Lending Institution

:max_bytes(150000):strip_icc()/6-benefits-of-using-a-credit-union.aspx_final-6e501699186e429ab6458d9e36ebe4a1.jpg)

Another advantage of credit rating unions is their democratic framework, where each member has an equivalent vote in choosing the board of directors. Credit rating unions usually provide economic education and counseling to help participants boost their monetary proficiency and make notified decisions about their cash.

Subscription Requirements

Credit report unions typically have certain standards that people should fulfill in order to come to be participants and accessibility their financial services. Membership needs for lending institution often involve qualification based on elements such as an individual's location, employer, business affiliations, or other qualifying partnerships. As an example, some cooperative credit union may offer individuals that live or work in a specific geographic area, while others might be connected with specific firms, unions, or organizations. Furthermore, family participants of existing credit history union members are usually qualified to sign up with as well.

To end up being a participant of a lending institution, individuals are generally needed to open up an account and maintain a minimum deposit as defined by the institution. In many cases, there might be single membership costs or continuous subscription charges. As soon as the membership standards are satisfied, individuals can enjoy the benefits of belonging to a lending institution, including accessibility to personalized monetary solutions, competitive rate of interest, and a focus on participant complete satisfaction.

Personalized Financial Providers

Personalized financial solutions tailored to specific needs and choices are a hallmark of credit unions' dedication to participant satisfaction. Unlike standard banks that frequently use one-size-fits-all remedies, credit rating unions take a more customized approach to handling their participants' finances. By comprehending the unique objectives and situations of each member, cooperative credit union can offer tailored recommendations on financial savings, investments, fundings, and other monetary products.

In addition, credit rating unions typically offer lower fees and competitive rate of interest on car loans and financial savings accounts, additionally boosting the individualized financial solutions they offer. By concentrating on specific needs and providing tailored solutions, credit scores unions set themselves apart as relied on monetary companions committed to aiding members prosper economically.

Community Involvement and Support

Community interaction is a keystone of cooperative credit union' objective, mirroring their dedication to supporting local campaigns and fostering purposeful connections. Credit unions actively Find Out More take part in community occasions, sponsor neighborhood charities, and arrange economic proficiency programs to inform non-members and members alike. By investing in the communities they serve, lending institution not just enhance their partnerships but additionally add to the general well-being of society.

Supporting small companies is an additional way credit report unions demonstrate their dedication to neighborhood communities. Via using tiny organization financings and monetary advice, cooperative credit union assist entrepreneurs prosper and promote financial development in the area. This assistance surpasses simply financial help; credit rating unions usually provide mentorship and networking possibilities to help small companies prosper.

In addition, lending institution frequently take part in volunteer job, urging their workers and participants to provide back with different social work activities - Hybrid Line of Credit. Whether it's joining neighborhood clean-up events or organizing food drives, cooperative credit union play an energetic duty in improving the lifestyle for those in requirement. By prioritizing area involvement and assistance, lending institution genuinely personify the spirit of participation and mutual aid

Online Financial and Mobile Applications

In today's electronic age, modern-day financial benefits have actually been changed by the extensive fostering of on the internet systems and mobile applications. Credit score unions go to the leading edge of this electronic makeover, supplying participants practical and safe and secure means to handle their funds anytime, anywhere. On-line banking services given by credit report unions enable members to inspect he has a good point account balances, transfer funds, pay bills, and watch deal background with just a few clicks. These platforms are designed with easy to use user interfaces, making it very easy for members to browse and gain access to important banking features.

Mobile apps offered by cooperative credit union better enhance the financial experience by supplying additional versatility and access. Members can perform various banking tasks on the go, such as depositing checks by taking a photo, getting account alerts, and also calling client assistance straight with the app. The safety and security of these mobile applications is a leading priority, with features like biometric verification and file encryption procedures to protect sensitive information. In general, debt unions' electronic banking and mobile apps encourage participants to manage their finances successfully and firmly in today's busy electronic globe.

Verdict

In verdict, credit history unions provide a special financial experience that focuses on neighborhood participation, personalized solution, and participant contentment. With lower fees, competitive passion prices, and customized financial solutions, debt unions cater to individual demands and advertise financial health.

Unlike banks, credit history unions are not-for-profit visit here organizations had by their participants, which commonly leads to reduce charges and much better rate of interest rates on financial savings accounts, fundings, and credit rating cards. Furthermore, credit history unions are known for their personalized consumer solution, with staff members taking the time to recognize the unique monetary goals and difficulties of each member.

Credit scores unions commonly use financial education and learning and therapy to help members enhance their economic literacy and make informed choices regarding their cash. Some debt unions may offer individuals that function or live in a particular geographic area, while others may be connected with details firms, unions, or associations. Additionally, household members of current debt union participants are commonly eligible to sign up with as well.

Report this page